Did you know it can take weeks or months to turn real estate investments into cash? This is because selling property is a longer, more complex process1. In contrast, you can quickly sell liquid assets like stocks and government bonds in public markets. They barely impact the asset’s price. This ease of turning investments into cash, known as liquidity, is key for attracting investors.

Liquid investments can be turned into cash fast and usually come with lower risk. On the other hand, least liquid investments, such as real estate, take longer to sell. This brings a unique set of factors for investors to think about. Grasping the effects of putting money into low liquidity options can aid in planning your portfolio. It helps to match your long-term financial aims.

Key Takeaways

- Liquidity indicates how quickly an asset can be converted into cash without affecting its market value1.

- Least liquid assets, like real estate and collectibles, may require months to sell2.

- Private equity shares in companies not traded publicly are among the toughest to sell fast1.

- Thinking about risk tolerance and how long you plan to invest is crucial when choosing low liquidity investments1.

- Liquid investments, such as stocks and mutual funds, allow quicker access to cash2.

Understanding Liquidity in Investments

Liquidity is key when you look at different investments. It means how quickly you can turn an asset into cash without its value dropping. The ease of this process depends on the asset, who wants to buy it, and the market.

Definition of Liquidity

Liquidity is how fast an asset can be cashed in without losing value3. Stocks, bonds, and ETFs are usually quick to sell because many people trade them every day4.

Factors Influencing Liquidity

Many things affect how liquid an investment is:

- Market conditions

- Volume of accessible funds

- Type of asset

- Regulatory environment

- Number of active market participants

Market liquidity makes it easier to buy or sell without changing prices much3. Liquid investments can be sold fast, making it easier for businesses or people to pay their bills quickly3. But, items like art or collectibles may take longer to sell and depend more on trends and finding the right buyer4. Investing in things like private equity takes a long time to see returns and you can’t pull out your money quickly4.

Knowing how easy it is to sell an asset is crucial. Tools that measure liquidity include current, quick, and cash ratios3. While stocks and bonds are easier to sell, real estate and collectibles might take longer and depend more on market conditions4.

For more on how liquidity affects investments, check out Ally Personalized Investment.

Which Investment Has the Least Liquidity?

When we talk about investments that are hard to turn into cash quickly, we look at a few key factors. Things like how easy it is to sell the asset, the asset’s market, and if there are rules that affect selling it matter a lot. Also important are how many people want to buy or sell and how much money is available4.

Criteria to Determine Liquidity Levels

To figure out which investments aren’t easy to cash in, we look at things like how often they’re traded. Also, how long it takes to sell them. Plus, if the asset is in a small market with few buyers, it’s harder to sell4.

Examples of Least Liquid Investments

Certain investments are really tough to turn into cash quickly. For example, putting money into private equity often means investing a lot of money. And you might not be able to get your money out for 5 to 10 years or even longer4. Venture capital is similar, with long waiting periods and it’s quite uncertain, making it not easy to sell fast4. Also, some real estate, especially commercial properties or ones in less popular places, can be hard to sell quickly4. Art and collectibles can also be tricky. Their value depends on what’s in trend and finding the right buyer can be hard4.

Then, there are unique cryptocurrencies. They’re not like the well-known ones and are harder to sell because fewer places accept them4. Retirement accounts like 401(k)s and IRAs are tough to get money out of without losing some to fees or taxes4. Lastly, savings bonds are a safer bet but turning them into cash isn’t quick because they take a while to mature45.

Private Equity Investments

Investors interested in options not easily sold often consider private equity investments. These involve buying stakes in firms not on the stock market. High-net-worth folks and big investors mainly go for them because they need a lot of cash and commitment. You might have to put in millions to get started.

The Nature of Private Equity

Private equity means putting money into businesses that aren’t listed on public exchanges. This choice isn’t like buying regular stocks because you can’t sell your share quickly. It’s best for investors ready to have their money locked in for a long time. They might get higher returns and some tax perks, like breaks on capital gains6.

Lock-up Periods in Private Equity

The lock-up period is a crucial part of private equity investments. Your money is tied up for a set time, usually five to ten years7. During this phase, pulling out your cash early is not usually an option. These long commitments mark private equity as a choice for patient money6. But, this time can help companies grow, possibly leading to big gains for the investors7.

Summing up, private equity looks for investors with a vision for the long haul and a hefty sum to invest. They lack the easy access of publicly sold assets. Yet, they offer chances for larger earnings and less concern over market swings for those who can manage their intricacies and wait-out periods.

Venture Capital

Investing in venture capital means giving funds to startups that might grow a lot. This investment asks for patience and accepts big risks.

Long-term Commitment

Venture capital investments need time, often years, to show profits. They’re not easy to sell off quickly. You have to be ready for this kind of long-term risk.

Exit Strategies

Exit strategies usually are an IPO or a buyout. Yet, these can take years to happen. Investors must be patient. The secondary market for venture capital is almost non-existent. This makes it tough to get returns quickly.

Venture capital has its risks, like market changes and economic issues8. Investors expect higher returns for the longer wait and low liquidity9. Moonfare offers some secondary market options for private equity, but it’s rare for venture capital10.

Even with these challenges, venture capital is appealing for those okay with the risk for possibly high rewards. Knowing these details helps in deciding to invest in venture capital. Spreading investments can reduce some risks8.

Real Estate Investment

Investing in real estate can be rewarding and challenging. It’s a low liquidity asset. You can buy properties directly or get shares in REITs11. Different investments offer different levels of easy selling, depending on location and demand.

Residential spaces in top spots are easier to sell. They offer more liquidity. On the other hand, commercial spaces in less desirable areas are harder to sell12. Selling these assets can involve complex rules and market issues.

REITs are like liquid mutual funds that act like stocks. They make diversifying in real estate easier11. Yet, REITs’ liquidity depends on market conditions, and their performance can vary. Real estate investment should match your long-term plans because it needs time and careful study12.

Understanding the risk-return is key in investment strategy. High liquidity assets offer quick cash but lower returns. Real estate might give higher returns but poses challenges like selling difficulties and value assessment12.

Real estate investment is vital for a diverse portfolio aimed at long-term goals. Mixing high and low liquidity assets manages risks and opens up chances for great returns over time.

Art and Collectibles

Putting money into art and collectibles isn’t easy due to their niche appeal. Finding the right buyer often requires expert knowledge and a specific audience13. Similarly, for collectibles like rare coins and antique items, there are not many places to sell them13.

Particularly, art investments take lots of time and work to sell at a good price14. The unpredictable changes in their value also affect how quickly you can sell them14. When you look into it, selling art and collectibles quickly is harder than selling stocks or bonds13.

Even though it’s hard to sell them, art and collectibles can bring in big money. Take Jeff Koons’ “Rabbit” sculpture; it went for $91.1 million in May 201915. Or consider a rare action figure from 1980 that could now be worth over $7,000, which is a huge jump15.

However, it’s important to remember that these items can be risky to invest in. They often have large differences between buying and selling prices14. This risk, along with the challenge of finding buyers, might make some think twice during uncertain financial times.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are liked by those who prefer not to risk their money. They come with a safety net, covered by the FDIC for up to $250,000 at each bank for every customer16. Yet, it’s important to think about the downsides. Early withdrawals can lead to penalties that eat into your earnings17

One downside is CDs’ fixed interest rates might not outpace inflation. This may weaken the value of your money over time17. In contrast, money market accounts offer easier access to funds. However, their yields are generally lower than what you’d get from CDs18.

CDs are available in many term lengths, from one month to 10 years. This variety helps you match your investment to your future plans18. A useful way to handle CD risks is by “CD laddering.” This strategy offers regular access to some of your cash without sacrificing interest18.

When looking at CDs versus bonds, bonds might have better yields in times of low interest rates. But, they also come with their own set of risks like changes in interest rates and inflation17. Choosing between CDs and bonds depends on what you’re hoping to achieve, how long you can invest, and how much risk you can handle17.

| Investment Option | FDIC Insurance | Yield Potential | Liquidity | Interest Rate |

|---|---|---|---|---|

| Certificates of Deposit (CDs) | Up to $250,000 | Fixed, generally higher over long terms | Low (due to penalties for early withdrawal) | Fixed |

| Money Market Accounts (MMAs) | Up to $250,000 | Variable, usually lower than CDs | High | Variable |

| Bonds | No | Variable, potentially higher than CDs | Moderate to High | Variable |

Grasping the benefits and drawbacks of CDs can lead you to a choice that fits your financial needs perfectly.

Exotic Cryptocurrencies

Exotic cryptocurrencies bring unique chances for investors but also hold big challenges, mainly in liquidity. These hard-to-sell digital assets are not found on many exchanges. This makes it hard to quickly buy or sell them.

For example, the worldwide crypto market was worth $1.5 billion in 2021. It’s expected to reach $2.3 billion by 202819. Yet, trading lesser-known cryptos is still tough because they’re not sold much and their prices can jump a lot. They’re like exotic pairs in forex trading, think U.S. dollar/South African rand or Euro/Turkish lira, known for big price swings and liquidity issues20. For tips on trading these pairs, check out this blog.

Liquidity is key in crypto trading. It affects how fast and at what price you can trade21. Since these assets sometimes have higher fees and big differences in buying and selling prices, traders need to think hard about the risks and rewards. Most liquid markets mean quick sales at going rates, yet new cryptos may rely on early sales and have a hard time finding enough buyers and sellers21.

Market ups and downs in exotic cryptos are like those in forex markets, for example with the U.S. dollar/Mexican peso. Factors like global events and bank rules play a big part20. But, traditional forex markets stay more liquid thanks to regulatory groups like the UK’s Financial Conduct Authority, which helps create a safe trading space19.

Finally, while trading exotic cryptos might look appealing for big gains, investors should know the risks well. Lower liquidity and bigger price changes mean trading these digital assets needs careful planning and lots of research.

Retirement Accounts

401(k)s and IRAs are vital for long-term money plans. They have rules against taking money out early because they are not meant to be easy to get to. Their main aim is to keep you financially secure when you retire, not to be used anytime.

When putting money into retirement accounts, knowing about liquidity is key. For instance, a 401(k) lets you pick from 8 to 12 investment choices. You can change these options to fit your risk level, a step known as rebalancing22. It’s important to spread out your investments in these accounts for growth, even with limits on access to your money.

It’s crucial to know when you plan to retire for effective investing. Target-date funds change their risk based on how close you are to retiring. They start off taking more risk and get more conservative as you get closer to retirement. This approach helps grow your money while keeping it safe22.

Early withdrawal penalties from retirement accounts are there to keep you from using the money too soon. These rules help save your original investment and its growth for retirement. Besides, some investments in these accounts, like bond funds, offer steady returns with less risk but might have lower gains compared to riskier choices22.

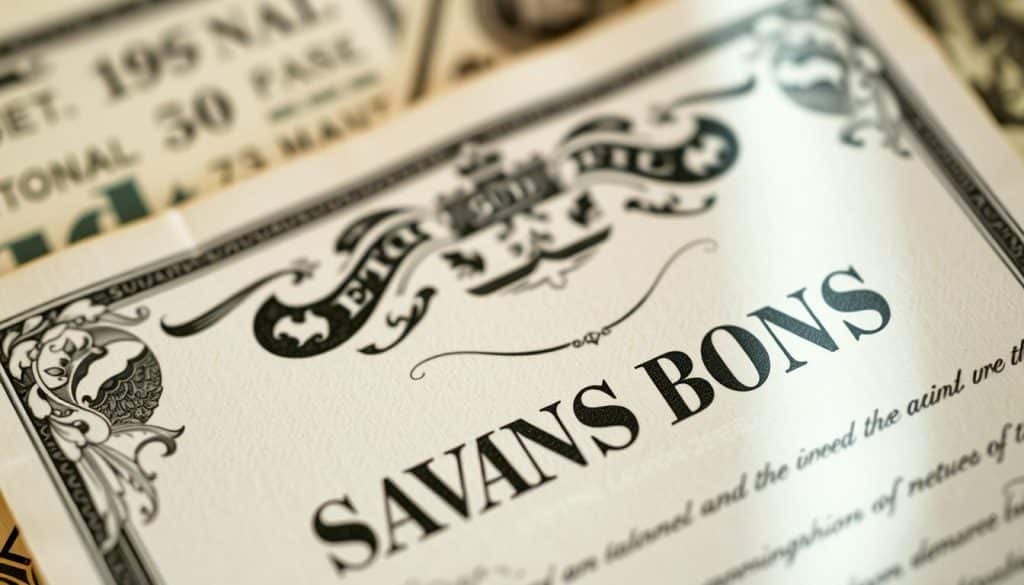

Savings Bonds

Savings bonds are a safe way to save money and earn interest. They come in Series I and Series EE types. Each has its own benefits. The interest rate for Series I Savings Bonds is at 4.28% between May 1, 2024, and October 31, 202423. These bonds grow in value because the interest is added every month and compounded twice a year23.

23. The least you can invest in I Bonds electronically is $25. Paper versions are sold from $50 to $1,00023. On the other hand, EE Bonds offer a steady interest rate of 2.10% through its life, as of January 202324.

Both I and EE Bonds have tax advantages. They aren’t taxed by states or locals on the earnings. But, the IRS still taxes them23. Using them for school costs could make the interest tax-free24. I Bonds’ interest changes every six months. EE Bonds are sure to double in 20 years, giving a solid investment24.

Savings bonds are good for a cautious investment plan. They are safer than stocks but have rules about when you can sell them. Cashing them too early means losing the last three months’ interest23. Being backed by the government makes them a stable choice for saving in the long run.

To learn more about U.S. savings bonds and compare them to other bonds, check out this informative guide23.

The Spectrum of Liquidity in Investments

Investments vary widely in how easily they can be turned into cash. Liquid assets like stocks and bonds can quickly become cash. On the other hand, investments like private equity and real estate are harder to sell. Knowing about this liquidity spectrum helps you shape your investment plan to match your financial goals and risk comfort.

Liquid Investments Examples

Easily sold assets can be turned into cash without losing value. Examples include cash, stocks from big companies like Microsoft and Google, and government bonds, such as U.S. Treasuries. These are popular because they have many buyers and sellers25. Investing in them is often seen as safer, and they let you quickly get to your money if you need it26. Experts suggest keeping 3 months to 1 year’s expenses in such assets for financial safety27.

Semi-liquid Investments

Some assets are in between liquid and illiquid, taking a bit longer to sell. Real estate and smaller-issued bonds are such examples. They strike a balance between being available and offering good returns, making them attractive for diversifying your investments while still having some access to your money26.

Illiquid Investments

Assets like real estate, private equity, and collectibles take the longest to turn into cash and you might have to lower the price for a quick sale25. These carry more risk but can promise higher rewards, appealing to big investors like pension funds despite being harder to sell26.

The Pros and Cons of Least Liquid Investments

Least liquid investments have upsides and downsides. Such investments can’t be quickly turned into cash but suit some investor strategies well.

Potential for Higher Returns

They’re known for the possibility of higher returns. Assets like real estate and private equity often go up in value over time28.Since they’re hard to sell quickly, they might bring in more money and be less bumpy in value.

Risks Associated with Illiquidity

But, these investments are risky, too. Liquidity risks mean it’s tough to get your money out fast or without losing value. Lands or collectibles could take a while to sell, unlike cash or stocks28.

Not being able to cash out easily can cause problems in emergencies when you need funds fast. The hope for more money comes with the risk of not being able to sell when you want or need to.

“The liquidity of an asset is important due to its influence on an investor’s ability to react to opportunities and financial obligations,” – Market Analyst.

Liquidity matters for handling short-term money needs. It means you can pay bills on time without selling things at bad prices28.

| Attribute | Liquid Assets | Illiquid Assets |

|---|---|---|

| Examples | Cash, Stocks, Bonds | Real Estate, Collectibles |

| Time to Liquidate | Immediate to few days | Weeks to months |

| Volatility | Higher | Lower |

| Returns | Moderate to High | Potentially Higher |

| Accessibility | Easy | Challenging |

Deciding between higher returns and liquidity risks needs careful thought. Know the good and bad of least liquid investments to make the best choice for you.

Differences Between Liquid and Illiquid Assets

Comparing liquid to illiquid assets, the main difference is how easy and fast you can turn them into cash. Liquid assets, like cash itself, stocks, and mutual funds, can be quickly turned into cash without losing much value29. Take gold and silver, for instance. They’re always wanted and are very liquid29. Plus, liquid assets often get better prices because they have smaller bid/ask spreads29.

Illiquid assets, meanwhile, include things like houses, cars, and old items29. Selling these takes more time and effort, usually needing a lot of negotiation29. Houses, which are often not quickly sold, might wait months for the right buyer29. These assets are tied up longer, making it harder to turn them back into cash quickly29. And their worth may change depending on the market when you decide to sell29.

The International Financial Reporting Standards (IFRS) say financial assets include quick-to-cash items like equity instruments and derivatives30. The FDIC secures liquid accounts up to $250,000, adding an extra layer of safety30. And companies like BlackRock Inc., with $10 trillion managed, invest in both asset types based on the market’s demands30.

Private equity funds show another side of this comparison. They’ve beaten public markets by more than 6% over two decades but require a long-term commitment31. Crowdfunding options also offer the chance for big gains but carry more risk and need time to cash out31.

Investment Strategies for Low Liquidity Assets

Creating investment strategies for low liquidity assets is about finding balance. You mix liquid and illiquid assets in your portfolio. This helps meet your financial goals while fitting your risk tolerance and investment timeframe.

Adding highly liquid assets like stocks, bonds, and ETFs is a smart move. These can be sold fast without losing value, thanks to their high trading volumes4. They bring liquidity that helps manage the constraints of low liquidity assets.

Investors can also look into semi-liquid investments, for more diversity. Some real estate and certain bonds fit this category. They’re not as quick to sell as highly liquid assets but offer more flexibility than the most illiquid options4.

Investments in private equity, venture capital, art, and collectibles require careful planning. They need you to commit for years, often with lock-up periods extending over a decade4.

Consider including fixed-income securities like CDs and deferred fixed annuities in your strategy. CDs guarantee returns for a specific time but charge penalties for early withdrawal. Deferred fixed annuities support retirement planning with growth and principal protection, despite their limited liquidity32.

| Investment Type | Liquidity Level | Characteristics |

|---|---|---|

| Stocks | High | Traded on major exchanges, short time to sell4 |

| Real Estate | Semi-Liquid | Varies with market conditions, moderate liquidity4 |

| Private Equity | Low | Long-term lock-up periods, high minimum investment4 |

| CDs | Low | Fixed returns, penalties for early withdrawal32 |

Conclusion

Liquidity matters a lot when you invest or plan your portfolio. It’s about how easily you can turn an asset into cash. This should be done without losing much value33. For instance, it’s harder to quickly sell things like houses or collectibles. They have low liquidity because not many people might want to buy them33. Cash, however, is super liquid. You can use it right away33.

Investing in private equity or venture capital means you need to think long-term. These don’t let you cash out fast33. But, if you understand the balance between getting returns and being able to access your money, you can make smarter investment choices. This helps you match investments with how much risk you’re okay with and your need for cash34. Spreading your investments across different levels of liquidity can reduce worry. It also makes your portfolio more stable and possibly more profitable.

To see if a company can pay its bills soon, we look at things like the current ratio, quick ratio, and cash ratio33. A higher number in these ratios means a company is in a good spot to pay off debts33. Also, knowing about Keynes’ ideas on why people hold cash helps. He talks about needing money for transactions, emergencies, and chances to make more money. This knowledge lets you balance your investments based on how much cash you need and what risks you can handle34. Understanding liquidity makes investing smarter, leading to a stronger, more flexible strategy.